Leadership & Expertise

Muta investment firm

Call us Now!

Youtube Channel!

Muta investment firm

This is not frontier investing. This is future investing.

● Early entry into fast-rising residential and commercial builds.

● Kigali and Nairobi offering 20–25% appreciation on off-plan units.

Nation-Building Projects with Predictable Cash Flows

We help you invest in roads, power grids, water, and ICT infrastructure areas governments are actively opening to private investors.

● Use PPPs, sovereign guarantees, or blended finance

● Markets: Morocco, Ethiopia, Senegal, Côte d’Ivoire

● Returns: 6–12% long-term, stable, often government-backed

Where Africa Is Leapfrogging the World

We scout and support disruptive innovation in:

● Fintech: mobile money, digital lending, insure-tech (Nigeria, Egypt, Kenya)

● Agritech: AI, drones, smart irrigation (Uganda, Ghana)

● Renewables: off grid solar, green hydrogen (South Africa, Namibia)

These sectors are backed by international capital but still underexposed in most portfolios.

● Deep-rooted local networks across East & West Africa.

● On-ground due diligence and relationship-based deal sourcing.

● Focused on risk mitigation, strong governance, and aligned incentives.

● We don’t just introduce you to deals we help you build relationships with real partners.

● Real Estate

● Infrastructure

● Health Care

● Financial Institution

● Commodities

● Industrials

● Funds

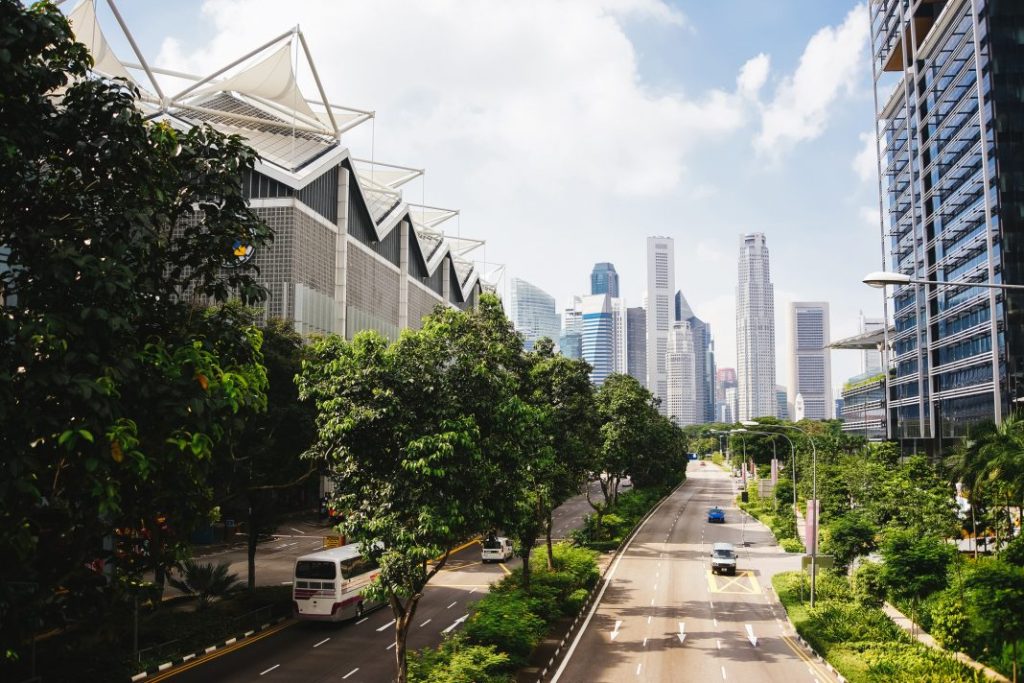

Explore the sectors where Muta Investment Firm helps global investors unlock Africa’s high

growth potential. At Muta Investment Firm, we specialize in connecting capital to opportunity ;identifying

sectors with measurable ROI, strategic growth, and local credibility. Below are the key

industries we focus on.

At Muta Investment Firm, we guide investors into off-plan residential projects, commercial property, and tourism-focused developments. Our model includes joint ventures with local landowners, allowing you to co-develop strategic sites in cities like Kigali, Kampala, and

Nairobi.

Kingdom Kampala,

Nile Avenue Kampala.

Mon - Sat: 09.00 to 06.00 (Sun:Closed)