Leadership & Expertise

Muta investment firm

Call us Now!

Youtube Channel!

Muta investment firm

At Muta Investment Firm, we unlock the potential of African real estate by connecting

investors with high-yield, future-ready projects across residential, commercial, and tourism

sectors.

● Urban population projected to double by 2050.

● Over 50 million housing units needed across Sub-Saharan Africa.

● Rapid urbanization in cities like Kigali, Nairobi, Accra, and Kampala.

● Rising demand for logistics hubs, commercial centers, and mixed-use developments.

Real estate is not just a safe-haven asset .it’s a critical infrastructure class powering Africa’s

economic takeoff.

Muta Investment Firm focuses on sourcing and structuring opportunities in:

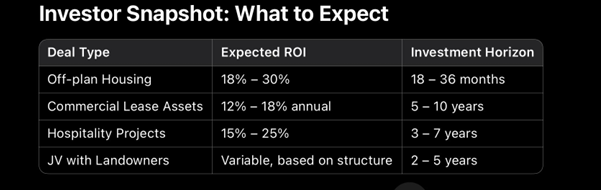

We partner with developers and local governments to deliver affordable housing in growing urban corridors. Investors access projects at pre construction stage with higher potential upside and structured exit plans.

Many Africans hold idle land but lack capital or technical know-how to develop it. Muta Investment Firm brokers joint ventures between foreign investors and vetted local landowners creating co-owned developments with clear legal structures and shared profits.

Capitalize on Africa’s rising tourism sector by investing in boutique hotels, eco-lodges, luxury residences, and resort developments in strategic locations. From the shores of Lake Kivu to the national parks of Uganda, the demand for quality hospitality is soaring.

We identify income-generating properties in retail, warehousing, and industrial zones. Projects often come with lease-back agreements, anchor tenants, or government incentives delivering stable returns.

● Rwanda: Kigali offers structured permits, clean titles, and a pro-investment climate.

● Uganda: Land abundance and booming middle class, especially in Greater Kampala.

● Kenya: Nairobi’s tech and logistics sector is drawing global attention.

● Ghana & Tanzania: Tourism, diaspora investments, and mixed-use growth corridors.

● Deep understanding of land markets, permitting processes, and local risks.

● On-ground teams to supervise project execution.

● Flexible deal structuring: equity, debt, co-investment, and SPVs.

● Proven track record in co-developments and investor syndication.

● Focus on impact and sustainability alongside ROI.

Kingdom Kampala,

Nile Avenue Kampala.

Mon - Sat: 09.00 to 06.00 (Sun:Closed)